Pvm Accounting Things To Know Before You Get This

Little Known Facts About Pvm Accounting.

Table of ContentsWhat Does Pvm Accounting Mean?Not known Facts About Pvm AccountingPvm Accounting Things To Know Before You Get ThisGetting The Pvm Accounting To WorkThe Pvm Accounting PDFsThe 5-Minute Rule for Pvm Accounting

Make certain that the bookkeeping process abides with the legislation. Apply called for construction bookkeeping requirements and treatments to the recording and reporting of building and construction activity.Interact with various funding firms (i.e. Title Firm, Escrow Firm) pertaining to the pay application procedure and demands needed for repayment. Help with executing and preserving interior monetary controls and treatments.

The above statements are meant to define the basic nature and degree of work being carried out by people assigned to this classification. They are not to be interpreted as an exhaustive checklist of duties, responsibilities, and skills required. Employees might be needed to do obligations beyond their typical responsibilities periodically, as needed.

About Pvm Accounting

You will certainly aid support the Accel group to make sure distribution of effective promptly, on budget, tasks. Accel is seeking a Building and construction Accountant for the Chicago Workplace. The Construction Accountant executes a range of audit, insurance coverage conformity, and project management. Functions both independently and within certain divisions to maintain monetary documents and make certain that all records are maintained current.

Principal duties include, however are not restricted to, taking care of all accounting functions of the company in a timely and accurate way and giving records and schedules to the company's CPA Firm in the prep work of all economic declarations. Ensures that all bookkeeping procedures and functions are handled precisely. Liable for all economic documents, pay-roll, financial and day-to-day procedure of the audit feature.

Functions with Job Managers to prepare and post all regular monthly invoices. Creates regular monthly Job Price to Date reports and working with PMs to resolve with Project Supervisors' budget plans for each task.

Our Pvm Accounting Ideas

Efficiency in Sage 300 Construction and Actual Estate (formerly Sage Timberline Office) and Procore building and construction management software program a plus. https://www.evernote.com/shard/s508/client/snv?isnewsnv=true¬eGuid=4404e321-52ad-dbea-8eba-d5e975e5f179¬eKey=IAq1oFQVQ3PnblqtDRJ-taVHQRcX3dvb_wpCe3pFQx9ozoYePcYu7Prtow&sn=https%3A%2F%2Fwww.evernote.com%2Fshard%2Fs508%2Fsh%2F4404e321-52ad-dbea-8eba-d5e975e5f179%2FIAq1oFQVQ3PnblqtDRJ-taVHQRcX3dvb_wpCe3pFQx9ozoYePcYu7Prtow&title=The%2BUltimate%2BGuide%2Bto%2BConstruction%2BAccounting%253A%2BStreamline%2BYour%2BFinancial%2BProcesses. Need to likewise be competent in various other computer software program systems for the prep work of reports, spread sheets and other audit analysis that might be required by monitoring. financial reports. Need to possess strong business skills and capacity to prioritize

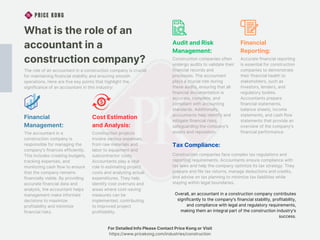

They are the monetary custodians who make sure that construction jobs continue to be on budget, follow tax guidelines, and keep financial openness. Building and construction accountants are not simply number crunchers; they are strategic partners in the building and construction process. Their main duty is to take care of the financial elements of building and construction projects, making sure that sources are allocated effectively and economic risks are reduced.

The 7-Minute Rule for Pvm Accounting

By preserving a tight grasp on job financial resources, accountants aid stop overspending and monetary setbacks. Budgeting is a keystone of effective building projects, and building and construction accountants are instrumental in this respect.

Construction accounting professionals are well-versed in these laws and make sure that the task conforms with all tax requirements. To stand out in the duty of a construction accounting professional, people require a strong academic structure in audit and finance.

Additionally, certifications such as Cpa (CERTIFIED PUBLIC ACCOUNTANT) or Certified Building Sector Financial Specialist (CCIFP) are highly pertained to in the industry. Working as an accounting professional in the building and construction industry comes with a special collection of challenges. Construction jobs usually include limited target dates, transforming regulations, and unexpected costs. Accounting professionals must adapt rapidly to these difficulties to keep the project's monetary health and wellness undamaged.

More About Pvm Accounting

Ans: Building and construction accountants produce and keep an eye on budget plans, recognizing cost-saving opportunities and guaranteeing that the job stays within budget. Ans: Yes, construction accounting professionals manage tax obligation compliance for construction projects.

Intro to Building Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction firms have to make difficult selections amongst numerous economic options, like bidding on one task over one more, selecting funding for materials or tools, or establishing a project's profit margin. In addition to that, building is a notoriously unpredictable industry with a high failing rate, slow-moving time to repayment, and irregular money circulation.

Common manufacturerConstruction business Process-based. Production entails duplicated processes with easily recognizable expenses. Project-based. Manufacturing calls for various processes, materials, and tools with varying costs. Fixed location. Production or production happens in a solitary (or a number of) controlled areas. Decentralized. Each job happens in a brand-new place with varying website conditions and one-of-a-kind obstacles.

Excitement About Pvm Accounting

Lasting partnerships with internet vendors relieve arrangements and improve efficiency. Irregular. Frequent use various specialty specialists and distributors affects effectiveness and cash money circulation. No retainage. Payment arrives in full or with regular repayments for the complete contract quantity. Retainage. Some portion of payment may be kept till job conclusion also when the service provider's work is finished.

Normal manufacturing and temporary contracts cause workable capital cycles. Irregular. Retainage, slow-moving repayments, and high in advance prices cause long, irregular cash flow cycles - construction accounting. While typical producers have the advantage of regulated settings and optimized production processes, construction firms have to frequently adjust to each new task. Also rather repeatable projects require adjustments due to website problems and other variables.